RAZORPAY

Payment success monitoring dashboard

Overview:

Enable business owners to track customer payments through multiple payment methods including credit cards, net banking, and UPI on the Razorpay platform.

Impact:

67% reduction in service tickets related to payment failures.

Role:

Owned the solution from initial problem definition through shipment, including user research, design iterations, high-fidelity prototypes, and close collaboration with engineering and product management.

Timeline:

Jan - Mar'25

Team:

Payment experience team

Payments failing is a detractor to business growth 🔻

Merchants invest significantly in customer acquisition and can't afford to lose them during payment.

When merchants experience high payment failure rates, it directly impacts their revenue, leading them to seek support from Razorpay.

Small and medium businesses frequently raise tickets for failure analysis, which our CS team addresses by investigating failed transactions. (900 tickets per month)

Small businesses

Less than 100 employees

Monthly payments under ₹5 million

Examples: Instagram sellers, local stores, Shopify merchants, dropshipping businesses

“I track all my payments on Razorpay dashboard”

“As a business owner, I keep checking failed payments but can't understand why they fail.”

Enterprise businesses

More than 100 employees

Monthly payments over ₹5 million

Examples: Tech startups, Walmart, Groww, Swiggy

"We track payments across various methods on our in-house dashboard"

"We have dedicated finance and accounting teams to monitor failed payments"

TARGET USERS → SMALL BUSINESSES 🏡 💰

Small businesses, operating with limited resources, struggled to understand payment failures on their own.

SOLUTION - 1

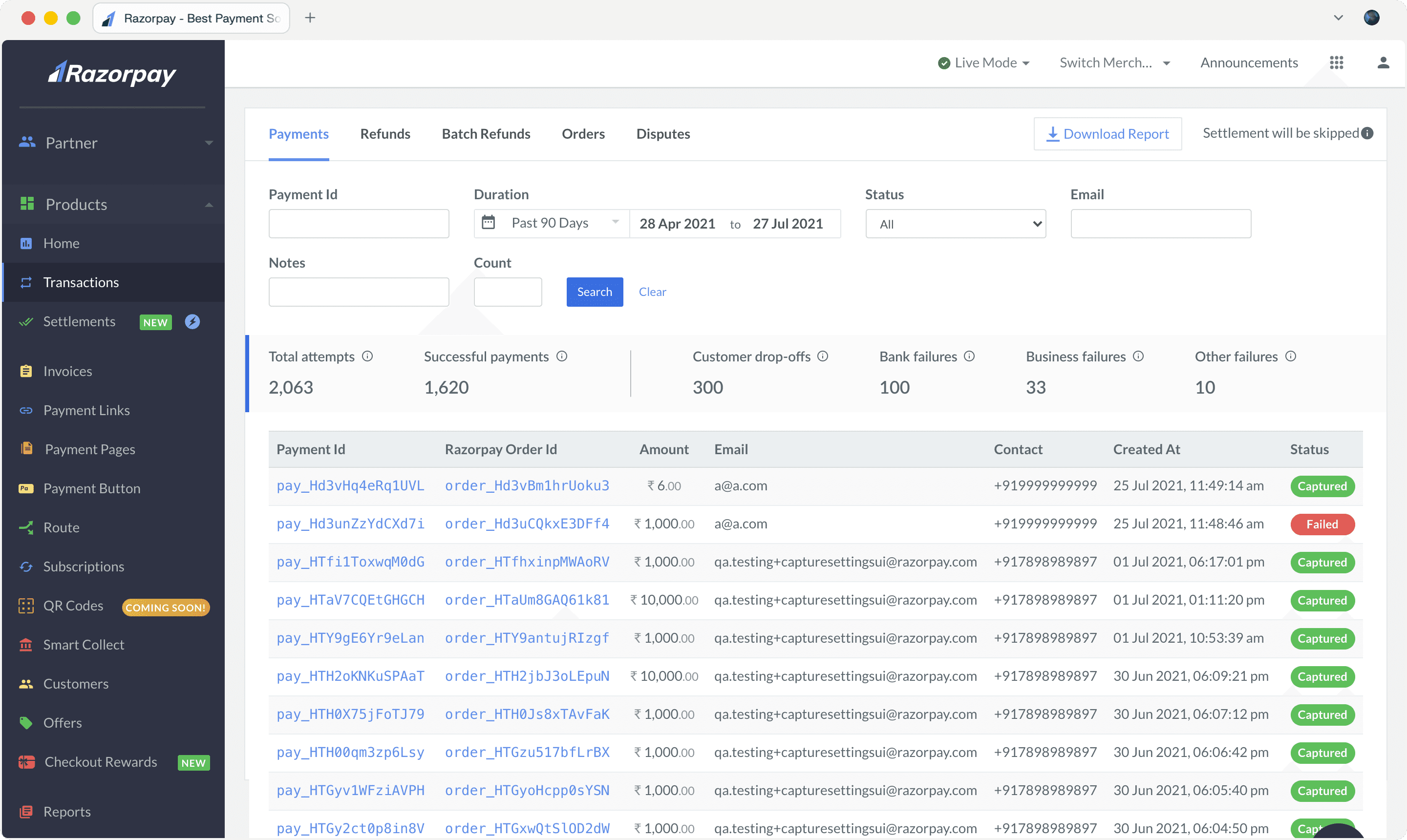

Analyse payments

Emphasized numerical data and failure reasons.

Streamlined the interface by moving explanatory text into tooltips, reducing visual clutter while keeping help accessible

We chose to enhance the existing payment tracking area, a familiar space for small merchants, ensuring the new features would be discovered naturally within their regular workflow

SOLVING FOR ENTERPRISE MERCHNATS

Next step was to provide payment method-specific insights, enabling merchants to track failures across different payment options like credit/debit cards, net banking, and UPI.

SOLUTION - ENTERPRISE

Success Rate Dashboard

Gateway Performance Visibility - Merchants lack clear insights into their Razorpay gateway's performance.

Payment Method Optimization - Without success rate data across payment methods, merchants can't guide customers to better options. For example, even if UPI has higher success rates, merchants can't promote it on their checkout page.

Downtime Impact Analysis - While real-time downtime alerts exist, merchants can't see how these outages affect their overall payment success rates.

These issues generate 200-250 support tickets monthly.

Manual PDF reports are sent to businesses.

Can we show this data on Razorpay dashboard?

Sample report sent by operations agent

SOLUTION - ENTERPRISE

Newsletter approach (iteration 1)

Pros:

Design works as both digital dashboard and email newsletter format, allowing weekly updates to merchants

Key information highlighted in summary card at top for quick insights

Cons:

Payment method breakdown was placed in second fold, while business owners wanted easier access to this data

Success rate trends were needed to understand downtime impact on overall performance

Newsletter approach

SOLUTION - ENTERPRISE

Progressive disclosure (iteration 2)

Pros:

Provides in-depth analysis for each payment method

Simple to scan and gives merchants a holistic view of success rates

Uses familiar design elements from failure framework, improving user recognition

Cons:

Payment method comparison between options like credit card and UPI was difficult. This metric is crucial as businesses use it to recommend payment methods to customers during checkout

Missing historical success rate trends made it hard to monitor downtime impact

Accordion to show information

Success Rate Dashboard

Payment method traffic distribution

Monitor trends - merchants should pay attention when the gap increases

Summary and insights

Elements carried forward from transactions

Downtime details

IMPACT AND ANALYSIS

Failure analysis framework is now live for all Razorpay users. Success rate dashboard has been rolled out to select 25,000 merchants.

Service volumes saw a 67% reduction 🔻

Fin

Thanks for reading. Scroll to see rough ideas and explorations