Terminal

App

Web

Designing Option chain for 600,000 traders on Groww

Helping options traders make faster decisions by reducing context switching, visualizing key metrics, and creating a layered data experience.

About Groww

Groww is an India-based investing and trading platform, similar to Robinhood, serving millions of users and offering stocks, F&O, and other investment products.

Overview

Options traders work best when they can move quickly and spot patterns, but traditional option chains with endless tab-switching and hard-to-find data often slow them down and push them to look elsewhere.

This project focuses on streamlining the workflow for traders. By reducing unnecessary steps and focusing on clarity, we help traders stay in their flow and make decisions quickly.

Outcomes

Previously, Groww did not cater to professional traders. Redesigning the option chain met the needs of these traders & made Groww competitive in the advanced-trader segment.

14% increase

Orders from option chain

600,000+

Option chain MAU

My role

I redesigned Groww's options chain from the ground up, transforming a basic interface into a pro-grade trading experience over 12 months.

Mechanics of trading options

Options 101

An option is like a paid reservation or a "coupon" that gives you the choice to buy or sell something at a set price later, without forcing you to actually do it. If the price moves in your favour, you use your coupon to make a profit; if it doesn't, you just throw the coupon away and only lose the small amount you paid for it.

Why should you trade options? Traders use options for leverage, which lets them trade expensive stocks with a tiny "down payment" to potentially multiply their profits.

Trade options at a fraction of the cost

Anatomy of an option

Option chain is list of all options available to trade

Think of the Option Chain as the "Coupon Store Website" where you go to buy those specific coupons we talked about earlier. Instead of just one coupon being available, this store lists thousands of different coupons for the same concert ticket (the stock).

Here is what the "Coupon Store" (Option Chain) looks like.

Anatomy of option chain

Reading an option chain

Think of the market at 25,600 as a Tug-of-War battle. Traders first check the price (the rope's position) but then look at open interest (the number of players on each side) to predict the winner.

If the Call side has significantly more players (open interest) than the Put side, it creates a massive "human wall" that blocks the price from rising, signaling strong resistance. A trader makes a decision by checking the price & OI to determine whether they want to buy a call or a put.

Used to compare price & open interest of different options

Try trading!!!

Trading simulator built with cursor

Problem deep dive

#1 It is difficult to see price & open interest at the same time

Traders could view either price or open interest, but not both simultaneously. They had to switch tabs to view the other. This made it hard to quickly compare both values. Without both values visible at the same time, traders had to keep switching views, slowing the process and making it inconvenient.

Switching tabs

#2 Traders can’t see their positions on the option chain

After entering a trade, traders returning to the options chain have no way to easily see which contract they hold a position in. This can lead to mistakes if they place an order under the wrong contract.

Confusion due to lack of position marker

#3 Traders need Greeks data

Another major issue was the lack of Greeks data. Competitors like Dhan and Sensibull provided detailed Greeks, including Delta, Theta, Gamma and Vega, but Groww did not. This information is essential for professional options traders, who use Greeks to understand how option prices might change due to time decay or market movements.

Groww was lacking advanced tools

NPS survey trader feedback

SUMMING IT UP:

Traders had to switch between viewing the price or open interest, with no way to see both at once. This made it harder to compare key metrics and slowed down decision-making.

Traders can’t see their positions on the option chain.

Additionally, professional traders could not access Greeks data (Delta, Theta, Vega), making it challenging to analyze option behavior in depth.

Problem deep dive

#1 It is difficult to see price & open interest at the same time

Traders could view either price or open interest, but not both simultaneously. They had to switch tabs to view the other. This made it hard to quickly compare both values. Without both values visible at the same time, traders had to keep switching views, slowing the process and making it inconvenient.

Switching tabs

#2 Traders can’t see their positions on the option chain

After entering a trade, traders returning to the options chain have no way to easily see which contract they hold a position in. This can lead to mistakes if they place an order under the wrong contract.

Confusion due to lack of position marker

#3 Traders need Greeks data

Another major issue was the lack of Greeks data. Competitors like Dhan and Sensibull provided detailed Greeks, including Delta, Theta, Gamma and Vega, but Groww did not. This information is essential for professional options traders, who use Greeks to understand how option prices might change due to time decay or market movements.

Groww was lacking advanced tools

NPS survey trader feedback

SUMMING IT UP:

Traders had to switch between viewing the price or open interest, with no way to see both at once. This made it harder to compare key metrics and slowed down decision-making.

Traders can’t see their positions on the option chain.

Additionally, professional traders could not access Greeks data (Delta, Theta, Vega), making it challenging to analyze option behavior in depth.

Process & Ideation

Chain is made from it’s list items. Let’s focus on solving for that.

Each option list item has three parts: the call side, the put side, and the center strike price.

List item in option chain

While solving for toggling problem we realized that traders didn’t need the exact OI number. They just needed to quickly spot which strikes had the highest OI, so they could find key support or resistance levels. Instead of showing a complicated table view with lots of numbers we chose to simplify and visualize open interest.

Price & OI view

Open interest explorations

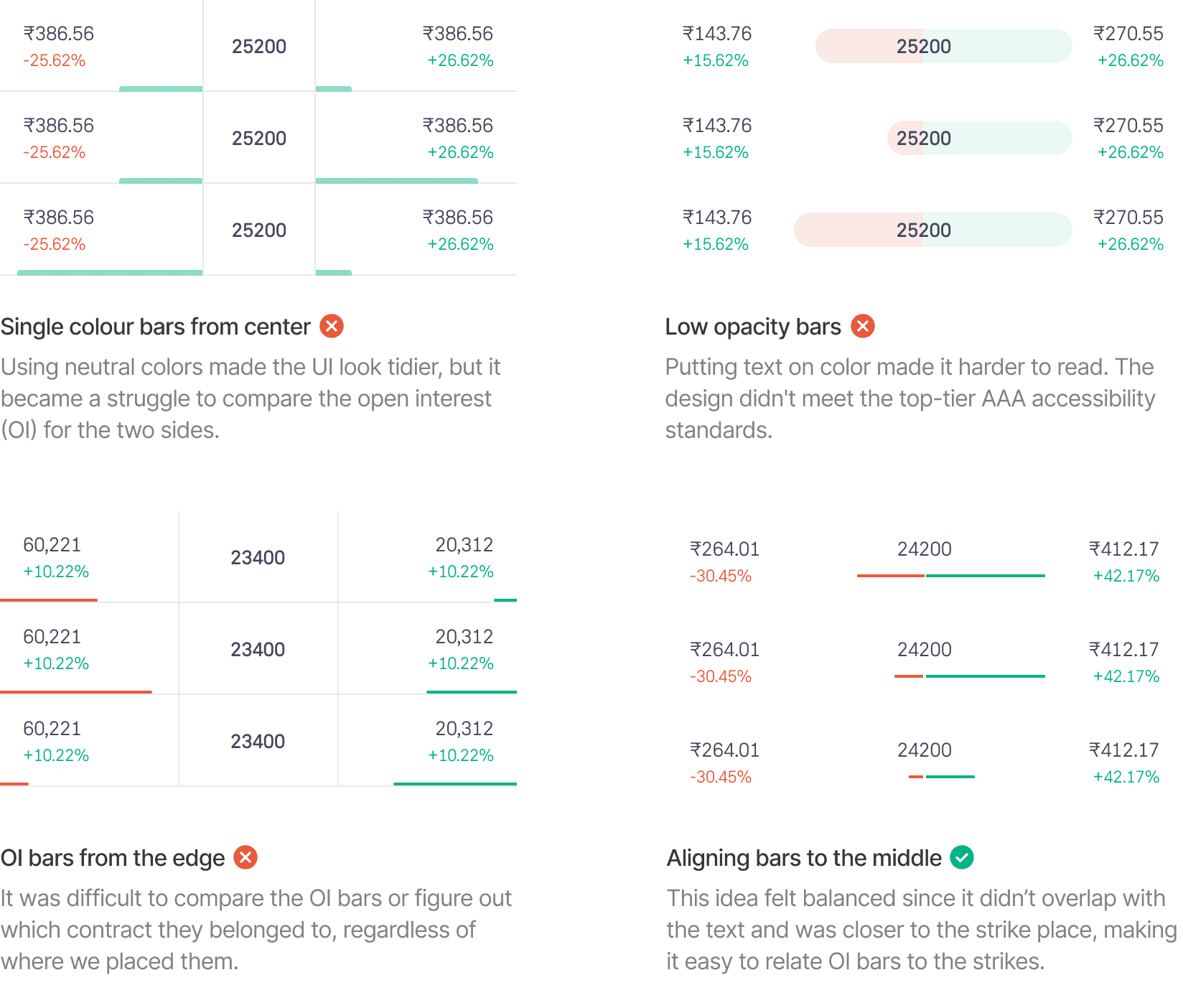

I tried multiple ways to visually represent open interest; here are a few ideas.

Position marker explorations

Second key challenge was figuring out how to show a trader’s positions for each contract in the option chain. The list item design we discussed earlier needed to include a way to display this information clearly. Here are a few iterations I explored:

Option chain with new open interest visualization & positions marker

Exploring how to show greeks on option chain

Let’s focus on professional traders, who rely on more than just price and open interest data; they also use greeks to decide which options to trade and where to place their bets. Although they make up less than 10% of all option users, they generate 20% of the revenue. As professional traders, they place more orders than the average user.

Greek as a separate mode

Users could switch to Greeks mode and select which Greeks they wanted to see.

Flaw: Price is essential for taking a trade. In Greek mode, users could no longer see the option price, which made it difficult to make trading decisions.

All columns in one view

UI was packed with data and hard to use on a mobile device.

Constant movement of the central spine made the layout confusing and didn’t help users stay oriented.

Throughout the process, my key design principle was to keep the data presentation as clean and digestible as possible. Excessive textual data can quickly become cumbersome and overwhelming. This can separate Groww from it’s competitors.

Greeks and open interest together

Traders can enable Greeks using a toggle in the option chain header. This way, users who don't want to see Greeks can keep their view simple, while those who need detailed data can turn on the full column view whenever they want.

Toggle to see all column view

Solution

Option chain features a 1:1 mapped scroll

This allows traders to compare data across multiple columns. This setup enables quick, side-by-side comparison of all Greeks and open interest values for both calls and puts in a single view.

Compare in one glance

Swipe to snap the center column

Traders focused on buying either a call or a put option can simply swipe the center spine left or right to get a focused view of calls or puts. This industry-leading feature, unique among competitors, was highly appreciated by traders.

Spine can snap to left or right

Reduced size of header by 33%

Maximizing visible options in a single view is critical for traders, so I also focused on reducing the header footprint.

User data revealed that most traders work primarily with the current expiry rather than frequently switching between multiple expiries, so quick-toggle access wasn't a need. We consolidated expiry selection into a dropdown and simplified the controls to two toggles, Greek and Basket mode.

Header before vs after

Solution

Option chain features a 1:1 mapped scroll

This allows traders to compare data across multiple columns. This setup enables quick, side-by-side comparison of all Greeks and open interest values for both calls and puts in a single view.

Compare in one glance

Swipe to snap the center column

Traders focused on buying either a call or a put option can simply swipe the center spine left or right to get a focused view of calls or puts. This industry-leading feature, unique among competitors, was highly appreciated by traders.

Spine can snap to left or right

Reduced size of header by 33%

Maximizing visible options in a single view is critical for traders, so I also focused on reducing the header footprint.

User data revealed that most traders work primarily with the current expiry rather than frequently switching between multiple expiries, so quick-toggle access wasn't a need. We consolidated expiry selection into a dropdown and simplified the controls to two toggles, Greek and Basket mode.

Header before vs after

Before vs After

Before

After

The new chain design was simple yet layered. By default, the interface remained clean and allowed users to place orders quickly. Advanced users could enable Greek mode to access Greek data. This way, the option chain served both new and professional traders.

The new chain design was simple yet layered. By default, the interface remained clean and allowed users to place orders quickly. Advanced users could enable Greek mode to access Greek data. This way, the option chain served both new and professional traders.

Designed to scale

Multi select to create a basket

Option Chain’s basket mode allows users to select multiple options at once. Previously, checkboxes were used, but they created visual clutter. To maintain a clean interface, I replaced them with subtle buy and sell indicators.

Basket experience

Same design scales to web

Option chain on web

Option chain on trading terminal

To sum up, here is what I did

Unified OI & price view

Data visualization that allowed traders to see both price & OI simultaneously without cluttering the screen.

Integrated greeks

Added greek data but kept it layered behind a toggle. Preventing overwhelming new users while giving pros the tools they needed.

Scaled to web and terminal

Made sure that the option chain experience felt similar for a trader using Groww on app, web or trading terminal.

Let's have coffee?

rakshit.design@gmail.com

Socials

Phone number

+1 (206)-571-4546

Blogs

Let's have coffee?

rakshit.design@gmail.com

Socials

Phone number

+1 (206)-571-4546

Blogs