Redesigning the order placement flow to reduce execution time and improve speed for F&O traders.

About Groww

Groww is an India-based investing and trading platform, similar to Robinhood, serving millions of users and offering stocks, F&O, and other investment products.

Overview

The project focused on speeding up the order placement flow for F&O traders on Groww. In F&O trading, prices can change every 0.3 seconds, so placing an order at the right moment at the right price is critical. The current flow, designed primarily for stock traders, was slow, leading to increased frustration among high-frequency F&O traders.

I re-examined the entire flow, identified and removed non-critical steps, and refined transitions. Ultimately, our shipped solution was 40% faster.

Outcomes

1.8 seconds

Time saved per order

6M+

Orders per day

100-120K

hours saved per day

My role

Owned the design end-to-end. Led prototyping, user testing, developer handoff and design systems documentation.

Let’s break down the problem

User problem

An F&O trader is someone who trades stock options rather than the underlying stocks, focusing on quick profits from volatility. For example, if a stock moves by one rupee, its option might move by ten rupees, making timing and price shifts crucial to their short-term strategy.

Problem: F&O traders need to place orders almost instantly because prices change in a split second. If the process is slow, they end up with a price different from what they expected, which directly affects their trading success.

Visualizing market speed

Frustated users

App experience problem

In the current Groww experience, the order flow had multiple steps that added unnecessary time. This design wasn’t optimized for the speed F&O trading demands, causing users to miss the ideal prices they wanted.

Old experience

Business problem

As a result of these issues, Groww was slower than its competitors. This meant traders had a reason to switch to other platforms, affecting Groww’s ability to retain F&O traders and remain competitive in the market.

2024 data

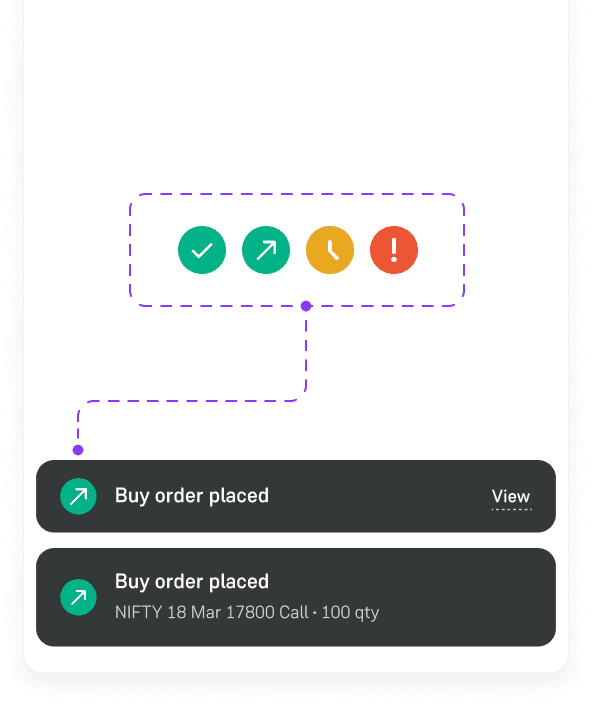

#1 Status screen → Status toast

The first solution was to convert the status screen into a status toast, allowing it to be removed. The status screen took about 1.2 seconds. By converting it into a toast, the user would land directly on the positions page after placing a buy order, saving 1.2 seconds.

The new status toast had to handle all the states that the status screen previously managed.

Redesigned status framework

Handling cases

#2 Fixing the transitions

Initially, there were three transitions in the step where the bottom sheet (with the buy/sell option) moved to the order card.

We streamlined this by scaling the bottom sheet directly into a full-screen order card, reducing the number of transitions. (Saved 0.6 seconds)

Pro tip: Transitions in financial apps should never be longer than 0.2 seconds. We used cubic ease-out for entering elements and cubic ease-in for exiting elements, ensuring that transitions felt quick and responsive. Source: Apple HIG

Before

After

Order card transition

Swipe to dismiss

Toast automatically dismisses after 4 seconds. This way, it wouldn’t be intrusive. Additionally, the user could simply fling the toast away to dismiss it manually.

Swipe to dismiss demo

Before vs After

Groww vs competitors

By eliminating unnecessary steps and reducing transitions, I saved ~1.8 seconds per order. Groww becomes more competitive in the F&O trading market.

Post launch